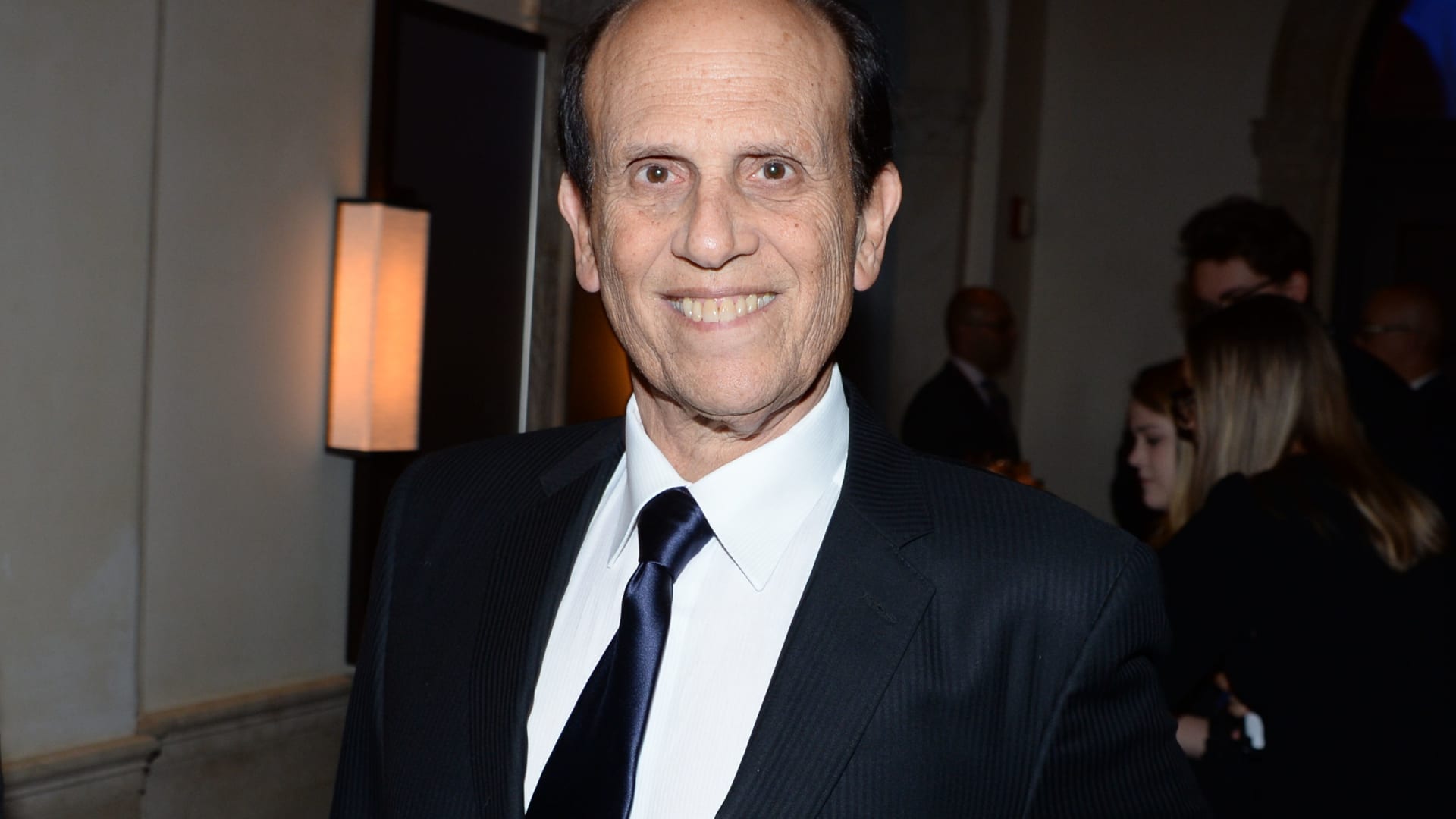

Famed investor Michael Milken expects the Federal Reserve will move slowly on monetary policy — if history is any guide.

In fact, the Milken Institute founder expects the central bank will be sure to tamp out inflation before starting to cut rates so as to avoid a repeat of the 1970s, when inflation ran high in the double digits, Milken said on CNBC’s “Last Call” on Monday. He was speaking from the Hope Global Forum in Atlanta.

“History, as you know, repeats in different ways,” Milken said. “In the ’70s, the Fed moved too early. And so yes, we came out of that ’74, ’75, ’76 period. But we had massive inflation at the end of the ’70s once again, with overnight rates up to 21%.”

“And so I think my view right now is the Fed is probably going to err a little bit on discipline today to see what’s occurred,” Milken added.

Inflation and interest rates ran high in the early 1970s before the Federal Reserve dialed back policy. This stop-and-go approach ultimately did not quell rising prices, however.

Fed Chair Jerome Powell will announce the central bank’s latest monetary policy decision Wednesday afternoon, when investors will review his comments for signs into when the central bank is expecting to start cutting rates.

In the 1980s, Milken was known as the king of junk bonds. The financier was an early pioneer of leveraged buyouts and, in 1990, pleaded guilty to securities fraud and tax violations. In 2020, he was pardoned by President Donald Trump.

–CNBC’s Yun Li contributed reporting.