Amid a busy new-issue day, munis could not help but follow a U.S. Treasury selloff that was led by stronger economic data, reaffirming that rates will remain higher for longer. Equities were down late in the session.

“The ‘higher for longer’ interest rate narrative continues to have a significant impact on all fixed income markets,” said Matthew Gastall, head of WM Municipal Research at Morgan Stanley.

Tuesday’s retail sales data helped to reinforce that economic health appears stronger than originally anticipated, he said.

Interest rates in the belly and the long end of the yield curve may “gradually move higher (term premium) if the Fed also decides to stay higher for longer with its benchmark policy, he noted.

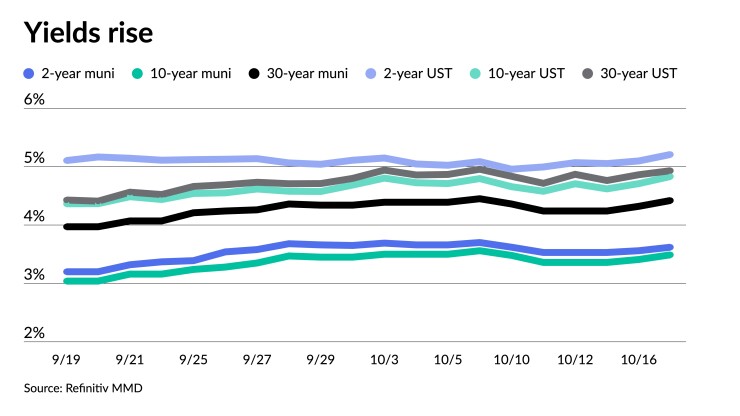

Triple-A yields rose six to 10 basis points while UST saw the largest losses at five years by as much as 15 basis points.

Munis are now following suit with broader Treasury market weakness, and “at the same time are also attempting to manage some of the healthiest issuance that we’ve seen this year,” Gastall said.

The new-issue calendar this week is estimated at $11.5 billion while Bond Buyer 30-day visible supply is at $15.07 billion.

The move up in yields “bodes well for total returns longer-term,” said Cooper Howard, a fixed income strategist at Charles Schwab.

“Most of the return from investing in fixed income is from the coupon and the higher level of yields, which should provide a buffer against a further move higher in yields,” he said.

Even if the five-year UST rises more than 100 basis points — something Howard does not expect to happen — an investor “would still achieve a positive one-year holding period return,” he noted.

Additionally, he said November and December tend to be “favorable months” for performance so returns may fare better in the near term.

Along with the recent weakness, munis are also “contesting with a surge of retail-sized selling, very likely as accounts swap old bonds for new to harvest tax losses,” said Matt Fabian, a partner at Municipal Market Analytics.

Retail tax swaps are usually long-term beneficial behavior, but he noted “coming this year amid still persistent mutual fund outflows, insurance company selling, and a seemingly accelerating pace of bank position unwinds, the net effect is chilling to overall performance,”

Therefore munis, “despite providing historically attractive income plus defensive coupons, high ratings, and safe sectors, are not yet attracting large scale demand and last week trailed UST long end performance by nearly half: tax-exempt AAAs up to 12bps better,” Fabian noted.

However, Howard argued now is still an attractive entry point for munis.

While falling slightly the past week, muni-USTs ratios “are at or above their three-year averages depending on the tenor,” he said.

The two-year muni-to-Treasury ratio Tuesday was at 69%, the three-year was at 70%, the five-year at 70%, the 10-year at 72% and the 30-year at 89%, according to Refinitiv Municipal Market Data’s 3 p.m., ET, read. ICE Data Services had the two-year at 71%, the three-year at 73%, the five-year at 73%, the 10-year at 74% and the 30-year at 91% at 3:30 p.m.

On mutual funds, the Investment Company Institute has 10 consecutive weeks of negative flows from muni mutual funds, totaling $10 billion of outflows, with $5.85 billion coming in the last three weeks.

Exchange-traded funds “have been modestly net gathering, but only recently (last two weeks) did that expand from just MUB, potentially implying a more permanent allocation to the tax-exempt sector.”

In the primary market Tuesday, RBC Capital Markets held a one-day retail order for $1.224 billion of special tax obligation bonds for transportation infrastructure purposes for Connecticut (Aa3/AA/AA-/AAA/). The first tranche, $875 million of new-issue bonds, Series 2023A, saw 5s of 7/2024 at 3.75%, 5s of 2028 at 3.55%, 5s of 2033 at 3.72%, 5s of 2038 at 4.30%, 5s of 2043 at 4.58% and 5s of 2044 at 4.61%, callable 1/1/2034.

The second tranche, $348.560 million of refunding bonds, Series 2023B, saw 5s of 7/2025 at 3.73%, 5s of 2028 at 3.55%, 5s of 2033 at 3.72% and 5s of 2034 at 3.79%, noncall.

Ramirez & Co. held a one-day retail order for $1 billion of future tax-secured tax-exempt subordinate bonds, Fiscal 2024 Series C, from the New York City Transitional Finance Authority (Aa1/AAA/AAA/), with 5s of 5/2025 at 3.72%, 5s of 2028 at 3.60%, 5s of 2033 at 3.78%, 5s of 2038 at 4.35%, 5.25s of 2043 at 4.57%, 5.25s of 2048 at 4.75% and 5.5s of 2053 at 4.77%, callable 11/1/2033.

Goldman Sachs priced for the California Community Choice Financing Authority (Aa3///) $647.750 million of green clean energy project revenue bonds, Series 2023F, with 5.5s of 10/2054 with a mandatory tender at 11/1/2030 at 5.07%, callable 11/1/2030.

Barclays priced for the North Texas Tollway Authority $576.965 million of system revenue refunding bonds. The first tranche, $439.475 million of first tier bonds, Series 2023A (Aa3/AA-//), saw 5s of 1/2026 at 3.93%, 5s of 2028 at 3.70%, 5s of 2033 at 3.84%, 5s of 2038 at 4.34% and 5s of 2042 at 4.62%, callable 1/1/2033.

The second tranche, $137.490 million of second tier bonds, Series 2023B (A1/A+//), saw 5s of 1/2030 at 3.87% and 5s of 2031 at 3.93%, noncall.

Siebert Williams Shank & Co. priced for San Antonio, Texas (Aa2/AA/AA/), $162.715 million of Electric and Gas Systems revenue refunding bonds, New Series 2023C, with 5s of 2/2024 at 4.00%, 5s of 2028 at 3.67%, 5s of 2033 at 3.82%, 5s of 2038 at 4.29% and 5s of 2042 at 4.53%, callable 2/1/2034.

Morgan Stanley priced for the New Mexico Finance Authority (Aa1/AAA//) $162.480 million of Public Project Revolving Fund senior lien revenue bonds, Series 2023B, with 5s of 6/2024 at 3.78%, 5s of 2028 at 3.56%, 5s of 2033 at 3.70%, 5s of 2038 at 4.22%, 5s of 2043 at 4.52% and 5.25s of 2048 at 4.66%, callable 6/1/2033.

Loop Capital Markets priced for the Ohio Water Development Authority (Aaa/AAA//) $100 million of water development revenue bonds, Fresh Water Series 2023A, with 5s of 12/2032 at 3.62%, 5s of 6/2033 at 3.66%, 5s of 12/2033 at 3.69%, 5s of 12/2038 at 4.19% and 5s of 12/2041 at 4.37%, callable 12/1/2033.

In the competitive market, Massachusetts (Aa1/AA+/AA/) sold $550 million of GOs, consolidated loan of 2023, Series D, to BofA Securities, with 5s of 10/2050 at 4.73% and 5s of 2053 at 4.77%, callable 10/1/2033.

The state also sold $275 million of GOs, consolidated loan of 2023, Series B, to BofA Securities, with 5s of 10/2026 at 3.47%, 5s of 2033 at 3.53% and 4s of 2038 at 4.31%, callable 10/1/2033.

The state sold $260 million of taxable GOs, consolidated loan of 2023, Series E, to Wells Fargo Bank, with 5.5s of 10/2026 at 5.14%, 5.5s of 2028 at 5.25%, 5.5s of 2032 at 5.52% and 5.7s of 2038 at par, callable 10/1/2033.

Additionally, the state sold $200 million of $200 million of GOs, consolidated loan of 2023, Series C, to Jefferies, with 5s of 10/2046 at 4.64%, 5s of 2048 at 4.69% and 5s of 2049 at 4.69%, callable 10/1/2033.

Secondary trading

Minnesota 5s of 2024 at 3.75%. Huntsville, Alabama, 5s of 2025 at 3.77%. Maryland 5s of 2026 at 3.64%-3.61% versus 3.60% Thursday and 3.56% original on 10/10.

Georgia 5s of 2028 at 3.44% versus 3.44% on 10/4. Massachusetts 5s of 2028 at 3.42%. LA DWP 5s of 2029 at 3.30%-3.31%.

NYC 5s of 2033 at 3.86%-3.85%. California 5s of 2034 at 3.65% versus 3.63% on 10/4. Triborough Bridge and Tunnel Authority 5s of 2034 at 3.90%-3.89% versus 3.82% original on 10/12.

Battery Park City Authority 5s of 2048 at 4.66%-4.67% versus 4.53%-4.52% on 10/2. Massachusetts 5s of 2052 at 4.37% versus 4.66%-4.67% Monday and 4.50% on 10/11.

AAA scales

Refinitiv MMD’s scale was cut six to 10 basis points: The one-year was at 3.70% (+6) and 3.62% (+6) in two years. The five-year was at 3.42% (+8), the 10-year at 3.49% (+8) and the 30-year at 4.42% (+10) at 3 p.m.

The ICE AAA yield curve was cut six to 10 basis points: 3.70% (+6) in 2024 and 3.65% (+6) in 2025. The five-year was at 3.46% (+9), the 10-year was at 3.49% (+9) and the 30-year was at 4.45% (+10) at 3:30 p.m.

The S&P Global Market Intelligence municipal curve was cut six to 10 basis points: The one-year was at 3.73% (+6) in 2024 and 3.65% (+6) in 2025. The five-year was at 3.46% (+8), the 10-year was at 3.50% (+8) and the 30-year yield was at 4.43% (+10), according to a 3 p.m. read.

Bloomberg BVAL was cut seven to nine basis points: 3.73% (+7) in 2024 and 3.67% (+7) in 2025. The five-year at 3.44% (+8), the 10-year at 3.52% (+8) and the 30-year at 4.46% (+9) at 3:30 p.m.

Treasuries sold off.

The two-year UST was yielding 5.208% (+11), the three-year was at 5.007% (+13), the five-year at 4.864% (+15), the 10-year at 4.831% (+12), the 20-year at 5.115% (+8) and the 30-year Treasury was yielding 4.929% (+7) at 3:30 p.m.

Primary to come:

The Wellstar Health System, Georgia, is set to price Wednesday $547.190 million of revenue bonds and revenue anticipation certificates, consisting of $296.195 million of Series 2023A (A2/A+//), terms 2048 and 2053; $56.935 million of Series 2023B (Aa1/AAA//), serials 2024-2043; $114.130 million of Series 2023A (A2/A+//), serials 2024, 2027-2032, 2041-2043 and 2053; and $79.93 million of Series 2023A (A2/A+//), term 2053. BofA Securities.

The School District of Philadelphia is set to price Wednesday $400 million of tax revenue anticipation notes, Series A of 2023-2024, serials 2024. BofA Securities.

The school district (A1//A+/) is also set to price Wednesday $332.450 million of GOs, consisting of $284.995 million of Series A, serials 2024-2043, term 2048, and $47.495 million of Series B, serials 2024-2043, term 2048. RBC Capital Markets.

The West Virginia Hospital Finance Authority (Baa1/BBB+//) is set to price Thursday $384.555 million of hospital refunding and improvement revenue bonds (Vandalia Health Group), Series 2023B, serials 2040-2043, terms 2048 and 2053. BofA Securities.

Charlotte, North Carolina (Aaa/AAA/AAA/), is set to price Thursday $219.785 million of GO refunding bonds, Series 2023B, serials 2024-2043. PNC Capital Markets.

The Arlington County Industrial Development Authority, Virginia (/AA+/AA+/), is set to price Wednesday $165.635 million of taxable Series 2023A and tax-exempt Series 2023B County Barcroft Projects revenue bonds, J.P. Morgan Securities LLC.

The Brownsburg 1999 School Building Corp., Indiana (/AA+//), is set to price Thursday $160.1 million of ad valorem property tax first mortgage bonds, serials 2027-2043. Stifel, Nicolaus & Co.

Cape Coral, Florida (/AA//), is set to price Thursday $138.085 million of Build America Mutual-insured utility improvement assessment refunding bonds (North 1 West Area), Series 2023. Morgan Stanley.

The Washington State Housing Finance Commission (/BBB//) is set to price Thursday $134.06 million of Seattle Academy of Arts and Sciences Project nonprofit revenue and refunding revenue bonds. Piper Sandler & Co.

The Colorado School of Mines Board of Trustees (A1/A+//) is set to price Thursday $133.53 million of institutional enterprise revenue bonds, consisting of $50.06 million of fixed-rate bonds, Series 2023C, and $83.47 million of term-rate bonds, Series 2023D. Morgan Stanley & Co.

The Conroe Independent School District is set to price Thursday $104.98 million of unlimited tax refunding bonds, consisting of $92.225 million of PSF-insured bonds, Series 2023A, and $12.755 million on non-PSF-insured bonds, Series 2023B. Piper Sandler & Co.

Competitive

The Empire State Development Corp., New York (Aa1//AA+/) is set to sell $377.825 million of state sales tax revenue bonds, Series 2023A (Bidding Group 2 bonds), at 11 a.m. eastern Thursday; $347.595 million of state sales tax revenue bonds, Series 2023A (Bidding Group 4 bonds), at 12 p.m. Thursday; $270.365 million of state sales tax revenue bonds, Series 2023A (Bidding Group 3 bonds), at 11:30 a.m. Thursday; and $213.51 million of state sales tax revenue bonds, Series 2023A (Bidding Group 1 bonds), at 10:30 a.m. Thursday.