The Regents of the University of California appears to have dropped Citigroup as a senior manager on an upcoming deal.

The issuer is set to come to market with general revenue bonds the week of Jan. 21, according to

Jefferies and Citi were previously listed as joint senior managers earlier this week, with Ramirez & Co. as co-senior manager.

Citi was replaced as a joint senior manager on the deal by Barclays and BofA Securities on Tuesday on the issuer’s investor website. Jefferies and Ramirez & Co. retained their position as joint senior manager and co-senior manager, respectively.

Citi declined to comment. The Regents of the University of California and the other underwriters could not be reached for comment.

The move came just hours after a resolution from Jefferson County, Alabama, was drafted that removed Citi as the book-running manager on the

Both decisions happened less than a week after Citi announced it would

At the time, Citi still planned to support its muni clients on “all pending capital issuances, including execution of pipeline transactions as well as transition to other underwriters as appropriate,” according to a company memo from the firm’s head of markets Andrew Morton and head of banking Peter Babej.

With Bond Buyer 30-day visible supply currently sitting at just over $3 billion, it’s unclear how many other issuers might have had Citi set to underwrite new issues.

How much impact having the lead manager drop off a deal could have depends on how complicated the credit structure is and how unique the bond structure is, said Stephen Heaney, who

While unfamiliar with UC Regents upcoming deal, he said the issuer has a deep underwriter pool and has used several different lead underwriters, large and small, on various deals, and usually do well.

For this upcoming deal, Heaney said, “Two weeks is short notice, but given the holidays I would wonder if much real pre-marketing has been done yet. It’s not ideal, but I doubt the issuers are disadvantaged.”

John Hallacy, a former managing director and head of research at BofA, who currently runs John Hallacy Consulting LLC, echoed Heaney’s sentiments.

“It’s not hard for one of the co-senior managers to step up,” Hallacy said.

“All of these deals always have what we used to euphemistically call the ‘bake off’ where all the firms present,” he said. The issuer picks “based on the best ideas and what the cost of the bonds are, and most firms had similar ideas.”

The issue is always whether the banks subbing in are big enough to take on larger deals, he said.

“Obviously Citi is a big player, though UBS was large,” Hallacy said, adding with those two firms gone, and if others follow suit, the question becomes whether there are enough remaining firms who can take on sizable transactions.

Hallacy said he thinks there are.

Around 95 underwriters did at least one muni deal last year, and this year that figure fell into the 80s, he said.

However, not all firms can take down a billion-dollar deal. This year, Hallacy noted, there have been at least 20 deals over $1 billion.

“Only so many firms can handle billion-dollar deals in terms of capital requirements,” he said. “They might need help from the co-senior managers.”

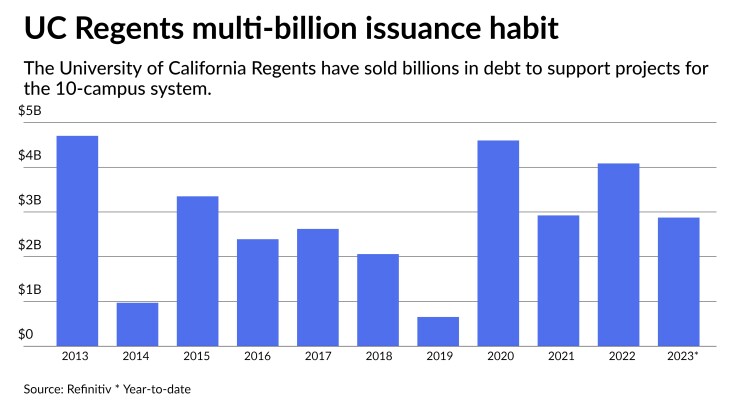

Since 2013, the Regents of the University of California have issued $31.23 billion over 64 deals, according to Refinitiv data.

So far this year, the Regents of the University of California have issued $2.875 billion over six deals versus $4.086 billion across five transactions in 2022.

That drop in issuance contributed to the issuer falling to 10th place in the rankings for the

The Regents of the University of California last came to market over the summer with $706.5 million of general revenue bonds. Siebert Williams Shank & Co. and RBC Capital Markets served as lead managers. Citi was listed as a co-manager on that deal.